What a Strong HRIS Discovery Process Actually Looks Like , A Consultant's Guide

- 3 minutes ago

- 6 min read

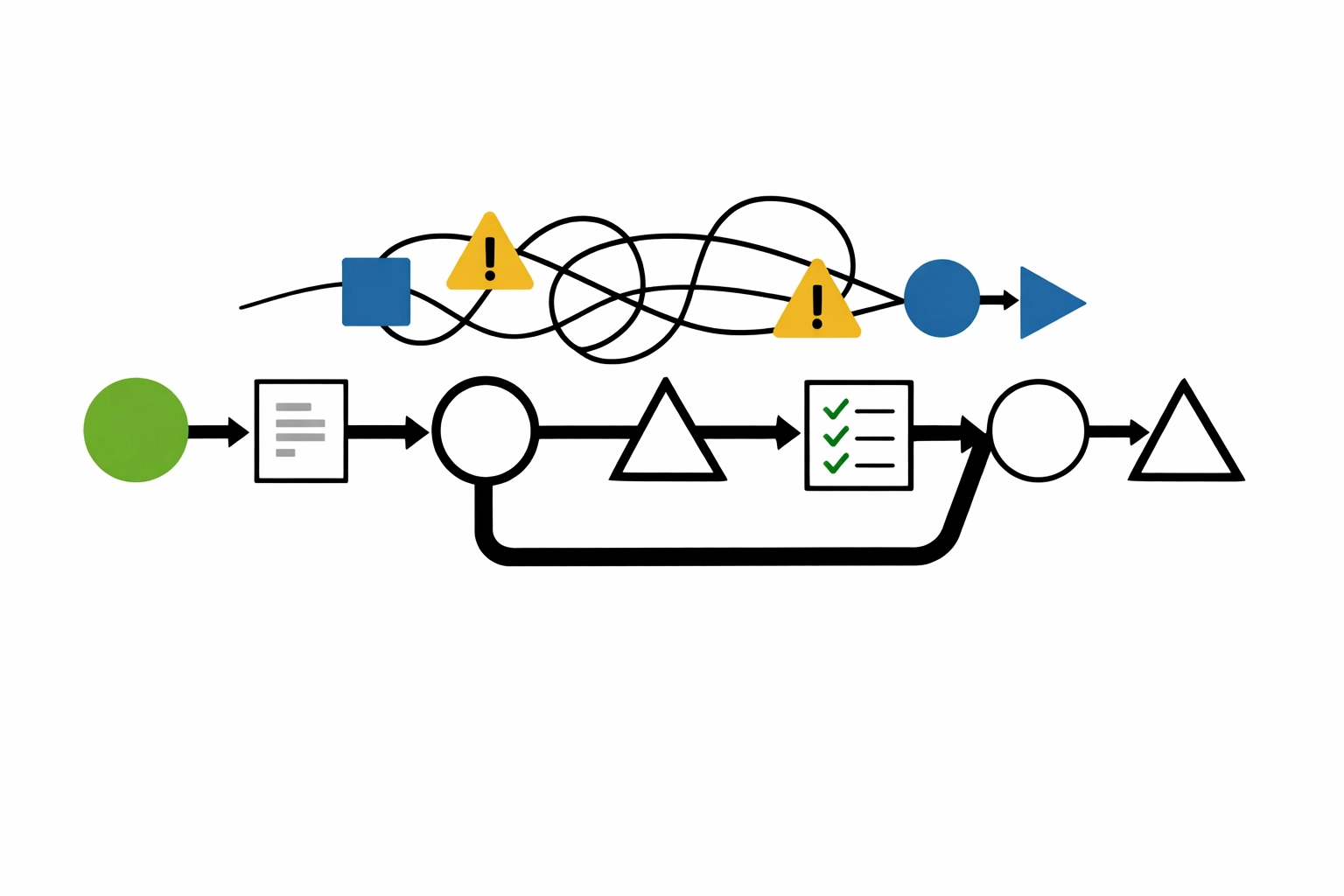

Here's the truth: most HRIS projects fail before the contract is even signed.

Not because the software is bad. Not because the team isn't committed. But because no one did the actual work to figure out what the company really needed in the first place.

As consultants who've managed over 50 HRIS projects, we've seen this pattern play out way too many times. A company gets excited about a shiny new platform, signs on the dotted line, and six months later realizes they've bought a Ferrari when what they needed was a pickup truck.

The discovery process is where that disaster gets prevented, or where it gets baked in. Let's pull back the curtain on what a strong discovery process actually looks like and why it's the most valuable (and most overlooked) part of any HRIS project.

Why Discovery Is Make-or-Break for HRIS Success

Think of discovery as the foundation of a house. You can have the most beautiful architectural plans in the world, but if the foundation is rushed or poorly executed, everything built on top of it will eventually crack.

A proper discovery process does three critical things:

It prevents expensive mistakes. When you skip discovery, you end up configuring systems based on assumptions rather than reality. That means paying for modules you don't need, missing features that are deal-breakers, and spending months in "workaround mode" because the system can't handle your actual workflows.

It builds organizational buy-in. When stakeholders feel heard during discovery, they become advocates for the project. When they don't, they become obstacles. We've seen implementations stall for months because a department head felt blindsided by a system they never got to weigh in on.

It creates a roadmap for ROI. Discovery isn't just about understanding what you need, it's about understanding why you need it and how you'll measure success. Without that clarity, you can't prove the value of your investment.

The JHHR Discovery Approach: Beyond the Surface-Level Checklist

Most vendors will send you a requirements checklist. You fill it out, they demo their product, and boom, you're supposedly ready to buy.

That's not discovery. That's a sales process disguised as discovery.

Real discovery requires digging deeper. Here's how we approach it:

Step 1: Stakeholder Interviews (Yes, Plural)

We don't just talk to the HR Director and call it a day. We interview people across the organization:

HR team members who live in the trenches of daily operations

Finance to understand payroll, benefits billing, and reporting needs

Department managers who approve time off, handle performance reviews, and need workforce data

IT to understand security requirements, integration constraints, and data migration realities

Executives to align the HRIS strategy with broader business goals

Each group sees the system differently. Finance cares about audit trails and GL integration. Managers want mobile approvals and easy reporting. HR needs compliance tools and efficient onboarding workflows. If you don't talk to all of them, you're building a solution for one stakeholder group that frustrates everyone else.

Step 2: Auditing Current Workflows (The Messy Reality)

This is where things get interesting. We don't just ask what people do: we watch how they do it.

We've discovered critical requirements by shadowing an HR coordinator for two hours and watching her copy-paste data between five different spreadsheets. That pain point never made it onto the initial requirements list because it had become "just how things work."

We map out the entire employee lifecycle:

How does someone get hired? What paperwork flows where?

How are benefits enrolled and tracked?

How does performance management actually happen (not what the handbook says, but what really happens)?

Where does data currently live, and who maintains it?

What manual processes exist that everyone hates but tolerates?

Step 3: Identifying Hidden Requirements (The Deal-Breakers)

Here's a secret: your biggest requirements often aren't on your initial list.

These are the "hidden" requirements that only surface through deep questioning:

Compliance landmines specific to your industry or location (looking at you, California)

Integration must-haves that aren't obvious until you realize your accounting system needs real-time payroll data

Scalability concerns when you're planning to double headcount in 18 months

User experience blockers like "our workforce doesn't have company email addresses"

Data migration nightmares involving decades of paper files or legacy systems with no export function

We once worked with a client who insisted they needed "basic HRIS functionality." Turns out they had 40% of their workforce as seasonal employees with complex rehire processes. That's not basic: that's a very specific requirement that eliminated half the vendors they were considering.

Moving Beyond Features: Process-First Thinking

This is where most companies get it backwards.

They look at software features and try to force their processes to fit. "The system tracks PTO this way, so I guess we'll change our policy."

That's insane.

A strong discovery process maps software to your actual business processes, not the other way around. Your processes exist for a reason: they reflect your company culture, your industry requirements, and your operational realities.

During discovery, we document:

What business outcomes you're trying to achieve (faster onboarding, better retention data, reduced compliance risk)

What processes currently support those outcomes (even if they're inefficient)

What's negotiable vs. non-negotiable in those processes

Then: and only then: do we look at which systems can support those processes. Sometimes that means configuring a system in a non-standard way. Sometimes it means choosing a less popular platform because it fits your workflow better. Sometimes it means building custom integrations.

But it always means putting your business first and the software second.

Identifying Deal-Breakers Early (Before You're In Too Deep)

Every company has deal-breakers. The question is whether you identify them during discovery or six months into implementation.

Common deal-breakers we help clients identify:

Missing compliance features for multi-state operations or specific industries

Integration limitations with existing systems that aren't going anywhere

Reporting restrictions that make it impossible to get the data you need

User capacity issues when you realize the "unlimited employees" plan costs 3x more

Mobile limitations for a primarily field-based workforce

Security gaps that won't pass your company's IT requirements

We literally maintain a "deal-breaker checklist" that gets refined during discovery workshops. It's not sexy, but it prevents expensive mistakes.

The Outcome: A Clear Roadmap for ROI

A strong discovery process doesn't end with a pile of notes and good intentions. It ends with concrete deliverables:

A prioritized requirements document that distinguishes between must-haves, nice-to-haves, and future considerations. Not everything needs to be implemented on day one.

A realistic implementation timeline based on your actual resources and bandwidth: not the vendor's optimistic estimates.

A total cost of ownership analysis that includes implementation fees, training time, data migration, integrations, and ongoing support: not just the sticker price.

Success metrics that matter to your business. Not "system goes live by Q2" but "reduce time-to-hire by 30%" or "eliminate manual payroll reconciliation."

A phased rollout plan that lets you start with core functionality and add complexity as users get comfortable.

This roadmap becomes your north star throughout implementation. When scope creep happens (and it always does), you have a document that says "this wasn't part of the original plan, and here's why we decided to prioritize other things."

Why DIY Discovery Usually Falls Short

Look, we get it. Hiring a consultant for discovery feels like an extra expense when you could just "figure it out yourself."

But here's what companies miss when they go it alone:

You don't know what you don't know. Without experience across multiple implementations, you can't anticipate common pitfalls.

Internal politics cloud judgment. An external consultant can ask hard questions and surface uncomfortable truths that internal teams avoid.

You lack pattern recognition. We've seen what works and what doesn't across dozens of industries and company sizes.

Time isn't actually free. Your HR team spending three months on discovery means three months of their regular work getting deprioritized.

The discovery phase is where a consultant's experience delivers the highest ROI. We've made all the mistakes already: on other people's projects. You're paying for us to prevent you from making those same mistakes.

The Bottom Line

A strong HRIS discovery process isn't about ticking boxes on a requirements list. It's about deeply understanding your organization's current state, future needs, and non-negotiable requirements before you commit to a solution.

It's about involving the right people, uncovering hidden requirements, mapping software to business processes instead of the other way around, and identifying deal-breakers before they become expensive problems.

And most importantly, it's about creating a clear roadmap that ensures your HRIS investment delivers actual ROI: not just a shiny new system that nobody uses.

If you're considering an HRIS implementation and want to make sure you get the discovery phase right, let's talk. Because the most expensive HRIS project is the one you have to redo.

Comments