The 2026 HRIS Readiness Checklist: What Every Company Should Prepare Before Implementation

- Justin Hall

- 7 days ago

- 5 min read

Let's be honest: HRIS implementations can go sideways fast. You've probably heard the horror stories: systems that don't talk to each other, employee data that disappears into the void, and payroll disasters that make your best people question their life choices.

But here's the thing: most HRIS failures aren't because of bad software. They're because companies rush into implementation without doing the groundwork. In 2026, with tighter compliance requirements and higher employee expectations, that preparation phase is more critical than ever.

This checklist will walk you through exactly what you need to have ready before your HRIS goes live. No fluff, no theoretical concepts: just the practical stuff that separates smooth implementations from expensive mistakes.

Start With Your Implementation Team

Assemble Your Core Team

Don't try to go it alone. Your HRIS implementation needs people who understand different pieces of your business:

HR lead (someone who knows your current processes inside and out)

IT representative (doesn't need to be your CTO, but someone who gets systems and integrations)

Finance/Payroll person (because when payroll breaks, everything breaks)

Department managers (they'll catch workflow issues you might miss)

Employee advocates (volunteer a few people to test and give feedback)

Define Roles and Responsibilities

Write down who owns what. Your vendor will handle the technical setup, but they can't read your mind about how your company actually works. Make sure someone internally owns data migration, process documentation, and user training.

Audit Your Current State

Document Everything You Do Now

Before you can improve your HR processes, you need to know what they actually are (not what you think they are). Map out:

How new employees get onboarded

Your current payroll cycle and approvals

Benefits enrollment processes

Time-off request workflows

Performance review cycles

Compliance reporting requirements

Clean Up Your Data

This is where most companies try to cut corners, and it always bites them later. You cannot dump messy data into a new system and expect it to magically organize itself.

Create a data inventory:

Employee records (current and terminated)

Payroll history

Benefits information

Time and attendance records

Training records

Compliance documentation

Flag any inconsistencies now. Missing Social Security numbers, outdated addresses, duplicate employee records: fix these before migration, not after.

Handle Compliance Requirements

Know Your Legal Obligations

2026 brought some new compliance headaches, especially around data privacy and wage transparency. Your HRIS needs to handle:

Payroll tax compliance (varies by state and gets updated constantly)

I-9 verification and document management

EEO reporting if you have 100+ employees

State-specific requirements like California's pay equity audits or New York's salary disclosure laws

Data privacy regulations if you have remote employees in different states

Review Your Policies

Your HRIS will enforce your policies, so make sure they're actually current:

Employee handbook

PTO policies

Remote work guidelines

Benefits eligibility rules

Disciplinary procedures

If your policies don't match what you're actually doing, fix that disconnect before implementation.

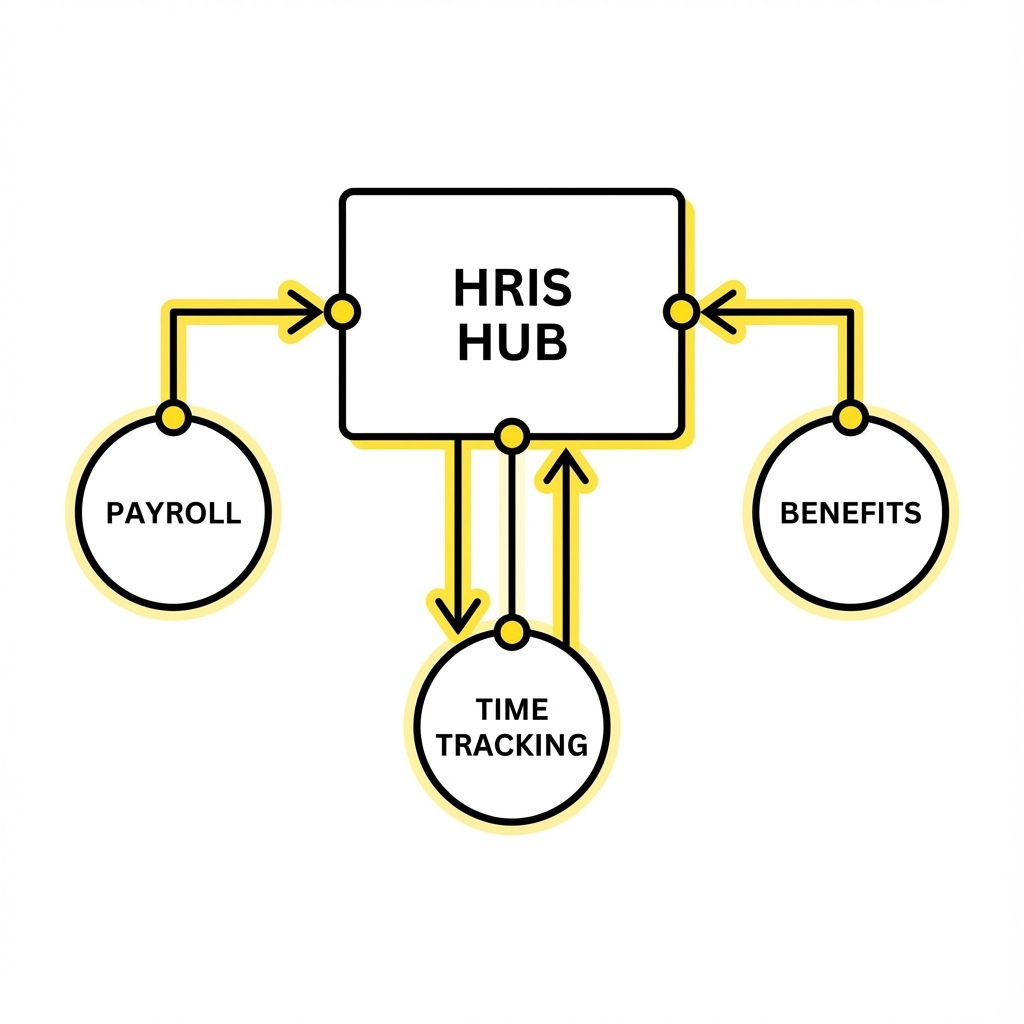

Prepare Your Technical Infrastructure

Check System Integrations

Your HRIS doesn't exist in a vacuum. It needs to play nice with:

Your payroll system (if separate)

Benefits providers

Time tracking tools

Accounting software

Background check providers

Map out every system that touches HR data and figure out how they'll connect. Some integrations are automatic; others require custom work: know the difference before you commit to a timeline.

Plan for Data Security

HR systems store sensitive information. Make sure you have:

Secure data transmission protocols

Role-based access controls

Regular backup procedures

Audit trails for data changes

Incident response procedures

Platform-Specific Considerations

If You're Implementing Paylocity

Paylocity shines with its user experience, but prep work is crucial:

Set up your organizational chart accurately: their reporting features depend on it

Prepare your benefit plan details in advance; their benefits admin tools are comprehensive but need complete setup

Plan extra time for their mobile app training: employees love it once they know how to use it

If You're Going with UKG

UKG's strength is in workforce management, but it requires more detailed configuration:

Map your pay codes and overtime rules precisely: UKG can handle complex scenarios but needs exact specifications

Prepare your scheduling requirements if using UKG Pro WFM

Budget time for their analytics training: the reporting capabilities are powerful but have a learning curve

Develop Your Training Strategy

Create Role-Based Training Plans

Not everyone needs to know everything. Break your training into groups:

Managers: Approvals, reporting, performance management

HR team: Full system administration, compliance reporting

Employees: Self-service functions, time entry, benefits enrollment

Payroll: Processing, corrections, reporting

Prepare Training Materials

Don't rely entirely on vendor training. Create internal resources:

Quick reference guides for common tasks

FAQ documents for your specific setup

Video walkthroughs for complex processes

Contact information for internal support

Plan Your Rollout Communication

Start talking to employees early. Let them know:

What's changing and when

How it will affect their daily routine

What training will be available

Who to contact with questions

Test Everything Before Go-Live

Run Parallel Systems

For at least one full payroll cycle, run your old system alongside the new one. Compare every number. This catches calculation errors, missing data, and integration problems before they affect real paychecks.

Test Common Scenarios

Don't just test the happy path. Try edge cases:

New hire starting mid-pay period

Employee requesting PTO during their first week

Manager approving overtime after payroll cutoff

Benefits changes during open enrollment

Validate Compliance Reporting

Run sample reports for all your compliance requirements. Make sure the data flows correctly and formats match what regulators expect.

Plan Your Go-Live Timeline

Set Realistic Expectations

Most HRIS implementations take longer than initially planned. Build buffer time into your timeline, especially around:

Data migration testing

Integration troubleshooting

User training completion

Parallel system testing

Choose Your Go-Live Date Strategically

Don't launch during:

Open enrollment periods

Year-end processing

Peak hiring seasons

Major company events or initiatives

The beginning of a new quarter often works well: less payroll complexity and cleaner reporting periods.

Post-Implementation Preparation

Plan Your Support Strategy

The week after go-live will be chaotic. Prepare for it:

Have extra HR staff available for questions

Set up a dedicated email or chat channel for issues

Create escalation procedures for urgent problems

Plan daily check-ins with your vendor support team

Monitor Key Metrics

Track leading indicators of implementation success:

Employee self-service adoption rates

Help desk ticket volume

Payroll accuracy metrics

Manager approval response times

Getting Started

This checklist might seem overwhelming but remember: every hour you spend in preparation saves you days of cleanup later. Start with the data audit and team assembly. Those two items alone will give you clarity on everything else you need to do.

The goal isn't perfection on day one. It's launching a system that works reliably and gets better over time. Focus on the fundamentals, test thoroughly, and don't skip the training. Your future self (and your employees) will thank you.

Ready to dive deeper into HRIS implementation strategies? Check out our guide on choosing the right HRIS for small businesses or learn about automating HR processes to maximize your new system's impact.

Comments